where does your credit score start canada

Its essential to keep your score on the high end of the scale but where do you start. However the starting credit score isnt zero.

How Important Is Your Credit Score In Canada Refresh Financial

If you live in Quebec you can.

. It begins when you apply for a credit card or a loan which is only possible once you turn 18 so your credit scores and reports. So how can you check your credit scores. A credit score is calculated based on information in your credit report a record of your borrowing and repayment activity.

Where does my score come from. Who creates your credit report and credit score There are two main credit bureaus in. As soon as you swipe your credit card for the first time your credit card provider utility companies and any other creditors will begin reporting your behaviour to the big credit.

At the age of 18 you start your credit score with 300 when you get a job a loan or a credit card. Your credit score will not start at the age of 18. What is a credit score.

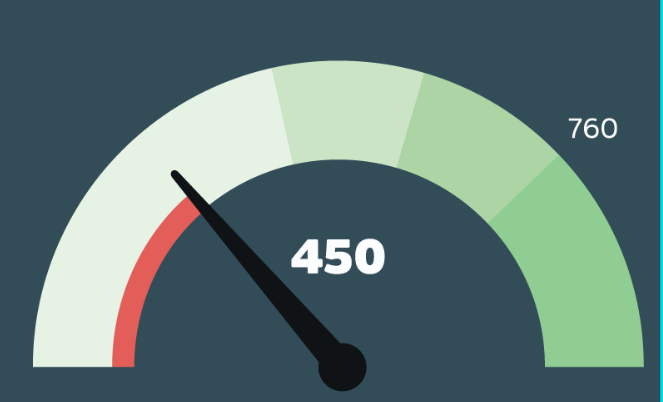

In TransUnions view a score that is above 650. It will slowly improve based on your financial performance. The FICO Score ranges from a minimum of 300 to a maximum or perfect score of 850.

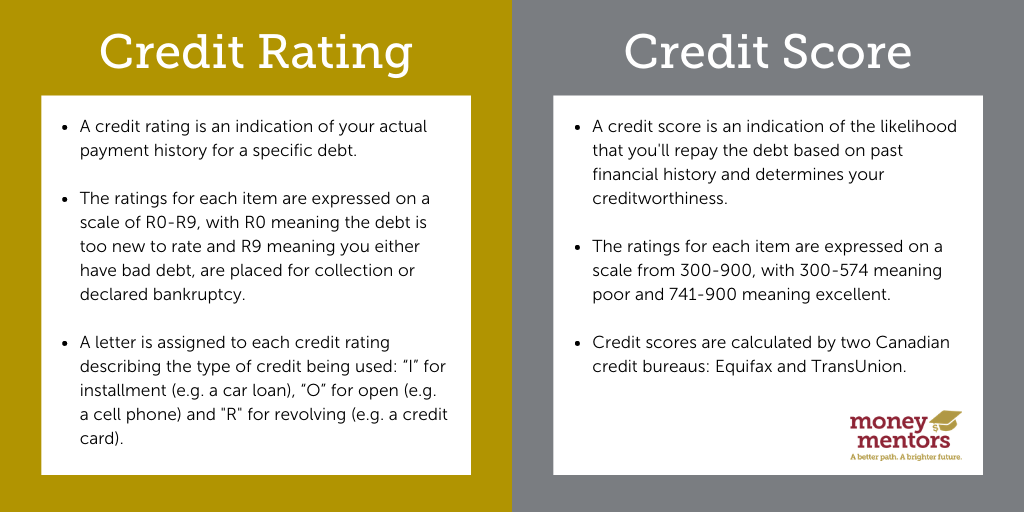

Here are a few ways. This is because a lender may give more weight to certain information when calculating your credit score. Though each credit bureau has a unique way of calculating your score.

Your credit score never begins at zero and is not calculated prior to turning 18 and doing the aforementioned because you might not have taken any loans to prove your creditworthiness. Keep in mind that this score is just an average taken by accounting for. How to Check Your Credit Score.

According to Borrowell the average Canadian credit score is 672 which is considered a fair score. Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Credit scores range from 300 to 900 and are split into categories.

The first step in establishing and building credit is understanding what comprises your credit score. If youre not sure what your credit score is its easy to find. Most peoples credit score doesnt start at the.

According to TransUnion 650 is the magic middle number a. Both Equifax and TransUnion provide credit scores for a fee. In Canada credit scores range from 300 just getting started up to 900 points which is the best score.

Credit risk is the likelihood youll pay your bills on time or pay back a loan on the. So what does your credit score start at once you qualify for one. Since credit scores range from 300 850 300 could be considered the starting score.

In Canada you will get credit scores as high as 900 points as a simple starting point. Your credit score is a three-digit number that measures how well you handle borrowing money. ViDI Studio Shutterstock Most Canadians begin their credit history with their very first credit card which they can get on their own by the.

Before you apply for credit and start accumulating points your FICO score does not exist. Its essential to keep your score on the high end of the scale but where do you start. You can access your credit score online from Canadas 2 main credit bureaus.

Helping business owners for over 15 years. Multiple hard inquiries within a short time indicate greater risk and can hurt your credit score. Your credit score from Equifax is accessible online for free and is updated monthly.

Equifax and TransUnion are the two main credit bureaus in Canada. In Canada there are two main credit bureaus that can create a credit report in your name. Purchase credit scores from a Canadian credit bureau.

The three main credit reporting bureaus Equifax. Their job is to.

Do I Have A Bad Credit Score And How Does It Affect My Life Legacy Auto Credit

What Credit Score Do You Start With In Canada

Modern Money Inc A Credit Score Is A Basic And Very Fundamental Part Of Our Banking And Financial System In Canada Your Credit Score Generally Ranges Between 300 900 And Your Score

Understanding Your Credit Score And Why It Matters Envision Financial

Credit Report Credit Score 10 Important Things To Know

How Long Does It Take To Improve Credit Score In Canada Lionsgate Financial Group

Business Vs Personal Credit Score What Is The Connection Bit Rebels

How Your Credit Score Impacts Your Financial Future Finra Org

Getting Going How To Wreck Your Credit Score Wsj

What Credit Score Do You Start With In Canada Financial Post

The Beginner S Guide To Canadian Credit Scores Debtbot

What Is A Good Credit Score Nerdwallet

7 Myths About Credit Ratings Credit Scores In Canada Money Mentors

What Credit Score Do New Canadians Start With 4 Ways To Start Building Credit

Minimum Credit Score For A Mortgage In Canada Nerdwallet Canada

Establishing Maintaining Credit Rating Td Canada Trust

Platinum Credit Card Capital One

How To Improve Your Credit Score In Canada What You Need To Know